In this post we look at inheritance tax in Switzerland the assessment of tax liabilities and inheritance tax rates. Good to know In most cantons a certain amount is tax-free In this case inheritance tax is only levied on the. Guide to Swiss Inheritance Tax Law for Swiss residents and non-Swiss residents covering the five methods for setting. Exemption of CHF 250000 regarding inheritance tax for each child then tax rate varies between 01 to 7 over. How much inheritance tax in Switzerland you pay depends on the tax rates in 26 cantons. Inheritance taxes to be expected in Switzerland Inheritance and gift taxes in Switzerland are under the..

Estate Taxes And Inheritance Taxes In Europe Tax Foundation

Hopes of inheritance tax reform were dashed in the 2023 Autumn Statement as chancellor Jeremy Hunt announced tax cuts for corporations and workers instead. An inheritance tax cut was seriously considered for the Autumn Statement in November but tax changes more directly focused on boosting economic growth were announced. Nuray Bulbul November 20 2023 at 431 AM 5 min read Jeremy Hunt has faced pressure from some Tory MPs to cut taxes before the next general election Jordan PettittPA Wire The Treasury. 0 The government is considering axing inheritance tax in three months time to boost chances of a Conservative victory at the upcoming general election. Inheritance tax IHT could be cut or eradicated in next weeks Autumn Statement amid improved public finances..

What are the inheritance tax thresholds in Germany for 2017-2018 The beneficiaries of the inheritance are taxed according to their taxable class The tax is calculated over their net. If you have received an inheritance which comprises German assets in particular German property this inheritance may or may not trigger inheritance taxes in Germany and or. Inheritance tax rates in Germany are consistent across the whole country They apply to savings property and other valuable assets but there are several. German Inheritance Tax applies when British Legators and their Lawyers least expect it UK and US lawyers are used to an inheritance tax regime where only the estate as such. To be able to access an estate in Germany you often need to submit a certificate of inheritance Erbschein issued by a German probate court a European Certificate of Succession..

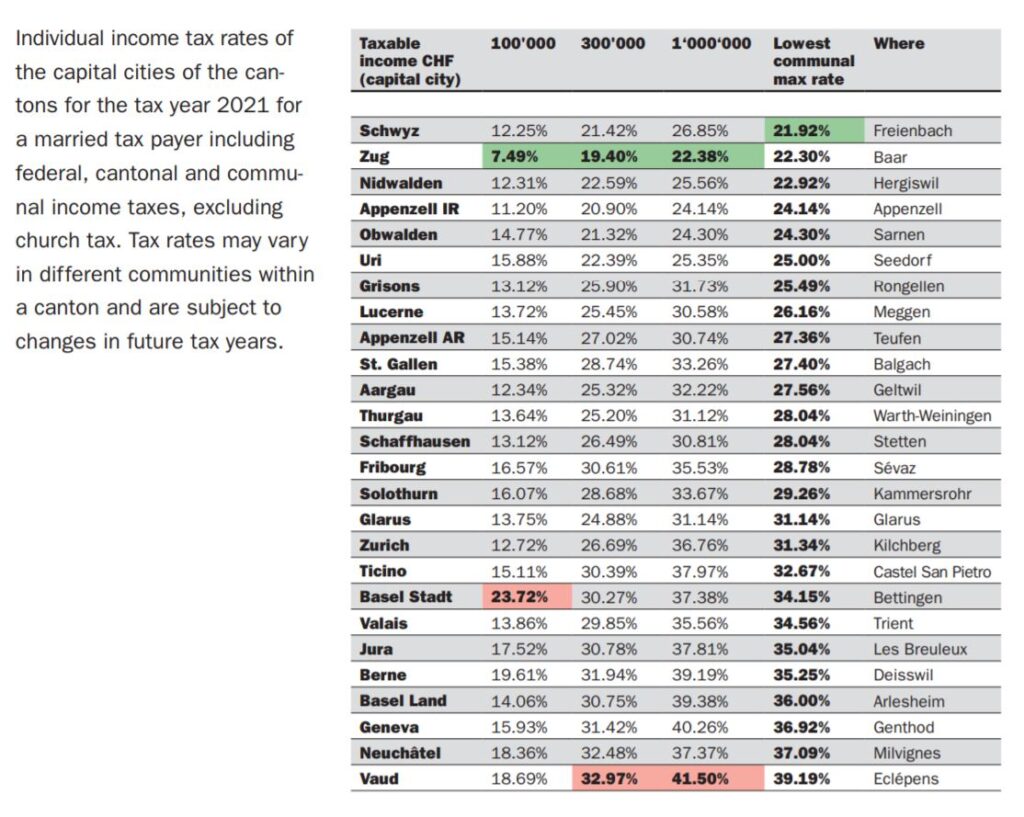

Taxes In Switzerland A Mini Guide To Swiss Tax How To Optimize

All information on inheritance tax amount entitlement and calculation in Austria can be found here Since August 2008 the inheritance tax in Austria has been abolished. . Fortunately there is no inheritance tax in Austria Essentially the process of inheriting property is the same as any other property transaction. Features of real estate inheritance in Austria - how to get a foreigner to inherit Austrian and EU laws forms how to inherit property - the will the contract by law. There is currently no inheritance tax in Austria but a transfer tax of 35 2 for close relatives is levied on the transfer of the property to the successor..

Tidak ada komentar :

Posting Komentar